Get ahead of financial crime

The rising complexity of financial crime demands a radically new approach.

That’s where Chorus comes in. We are trusted by the Financial Conduct Authority, major global banks, and the majority of law enforcement and government agencies complex crime teams.

We analyse 200 million risk and intelligence events per day. With us, you can achieve fundamental, far-reaching change.

Highly sophisticated threats

Money underpins all crime. As technologies evolve, so do the lawbreakers. And so should you.

The ugly truth is that financial crime is winning. It outstrips the cost of regulation, compliance, fines, and fraud. And left unchecked, it erodes credibility in the global financial ecosystem.

Financial institutions spend a combined $188 billion across financial crime compliance technology and operations. In the UK alone, it’s almost $45 billion – yet barely 1% of the UK’s dirty money is detected.

Criminals constantly have the upper hand. They are more innovative, agile, and determined. They have more to gain, and more to lose. Combine this with malicious insiders and the escalating cyber threat, and there’s a near-insurmountable challenge to deal with.

Out-think, outsmart and outmanoeuvre

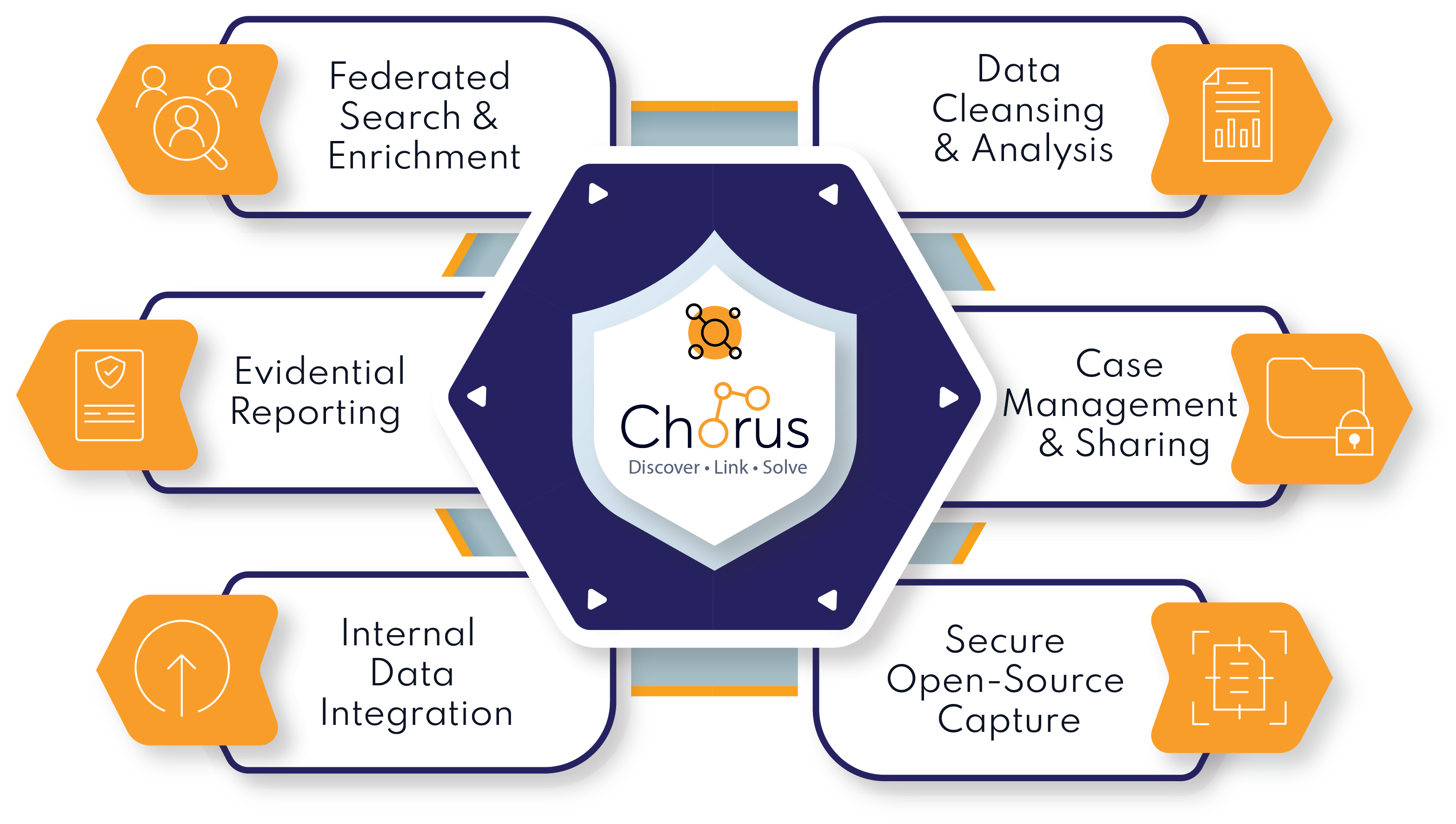

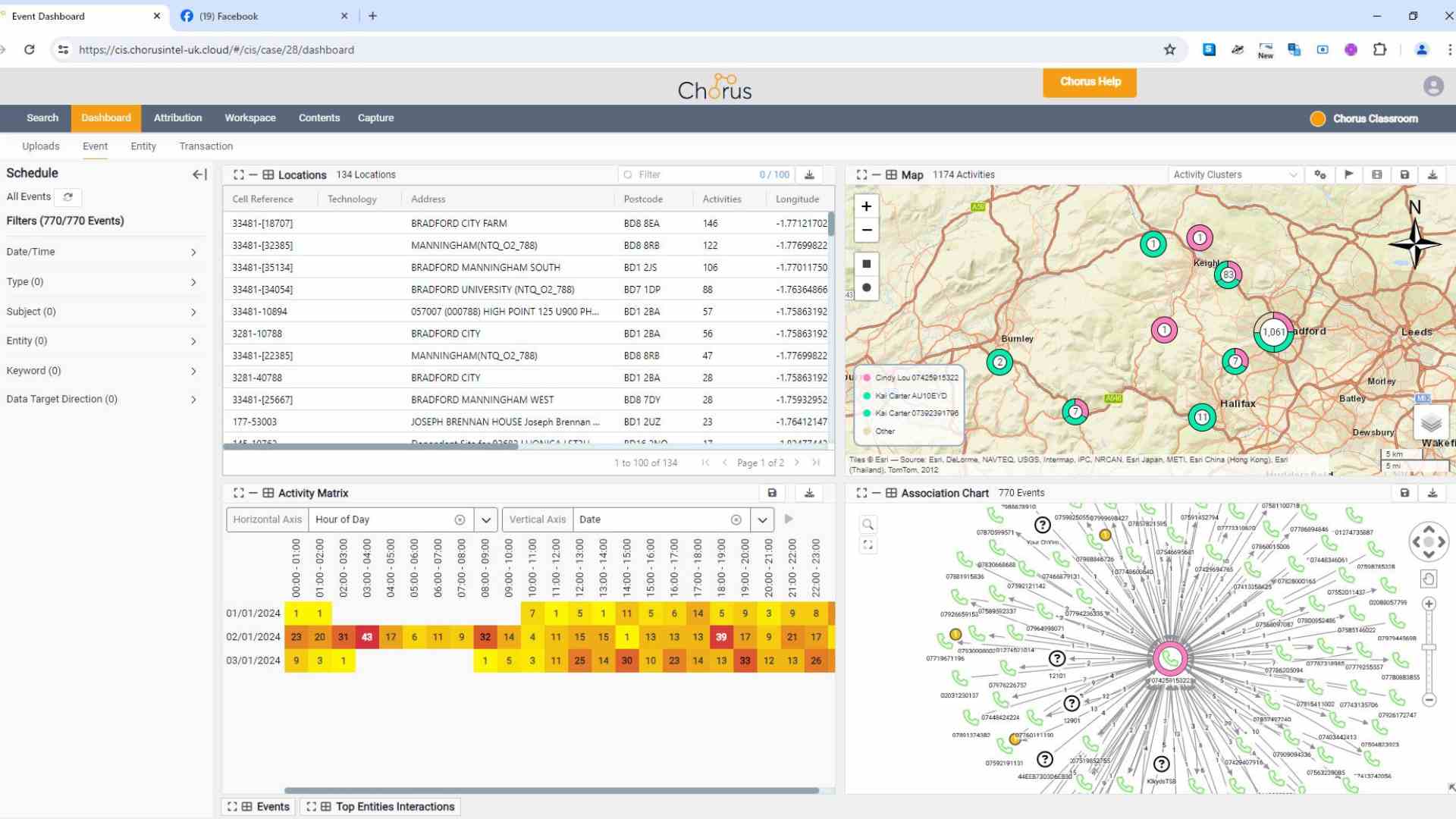

The Chorus Intelligence Suite (CIS) gives you the power to uncover and shut down networks of fraud and money laundering. It moves you from reacting, monitoring, and reporting, into the realm of proactivity and prevention.

Getting to the heart of financial crime involves complex investigations. We know the pressures you’re facing. Crime is up, and resources are down.

Most of financial crime is digitally enabled. That’s why we amplify your digital capacity, empowering you through an easy-to-navigate analytical system.

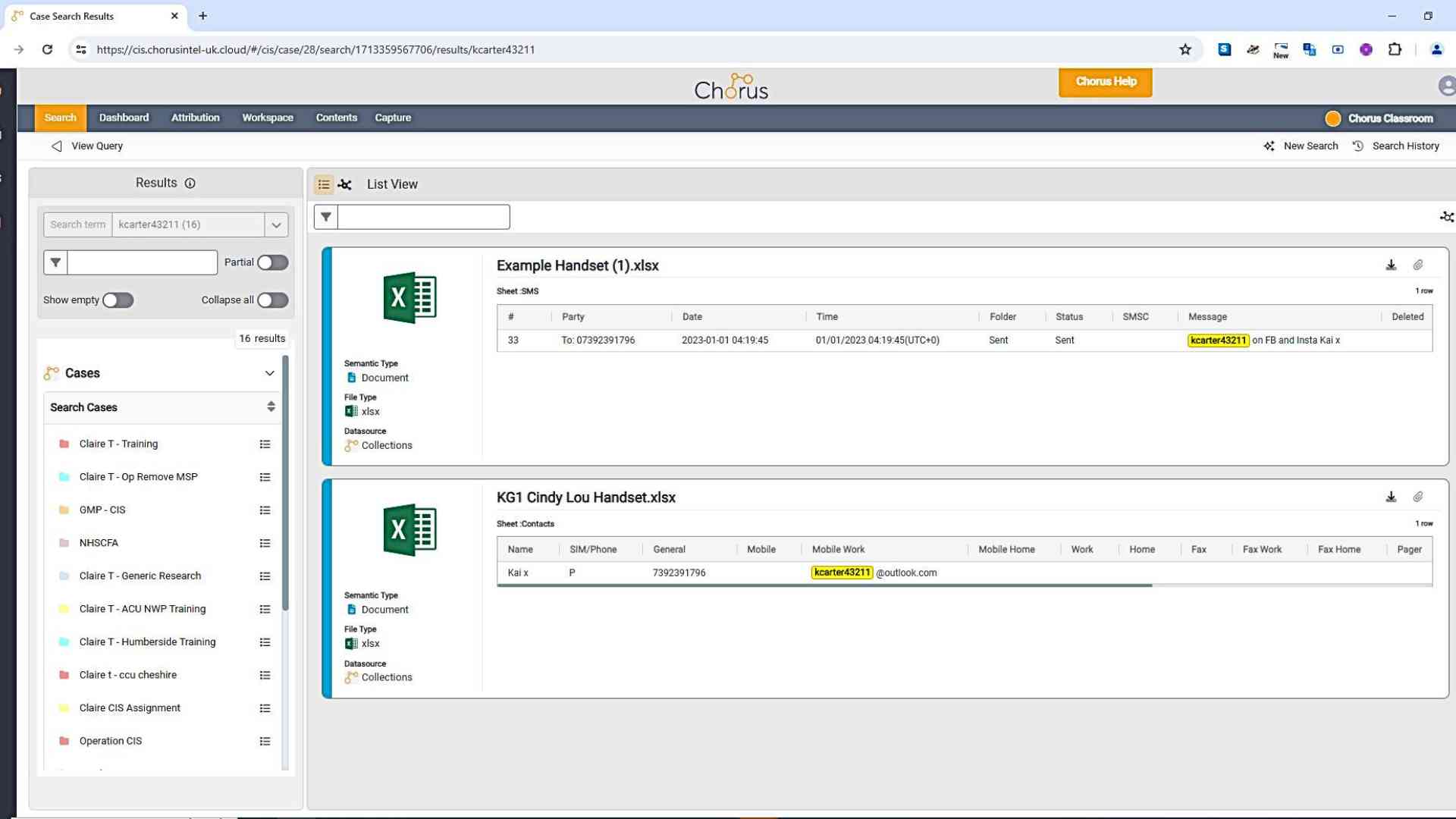

Leverage the CIS to cleanse, combine, and connect internal, consented, and external data to easily spot connections. Share intelligence with colleagues, partners, and external organisations, all from a single interface.

The CIS is securely hosted in the cloud, browser-based and accessible from anywhere. Plus, it’s compatible and interoperable with your existing IT suite.

Key Features

Data Cleansing & Analysis

Chorus processes and analyses 200 million risk events per day!

Ingest data from multiple sources to be automatically cleansed and formatted, saving 97% of your time. Data can include all account, transactional and payments events.

Perform analysis to evaluate its relevance. Create a sequence of events and network visualisation for investigation, attributing unknown information instantly.

Internal Data Integration

Centralise disparate internal data to discover unknown intelligence

Securely upload, index and assimilate local structured and unstructured data and search against all other data held in the CIS to determine possible connections.

Integrate into and search internal customer databases, core banking platforms and other fraud and AML repositories.

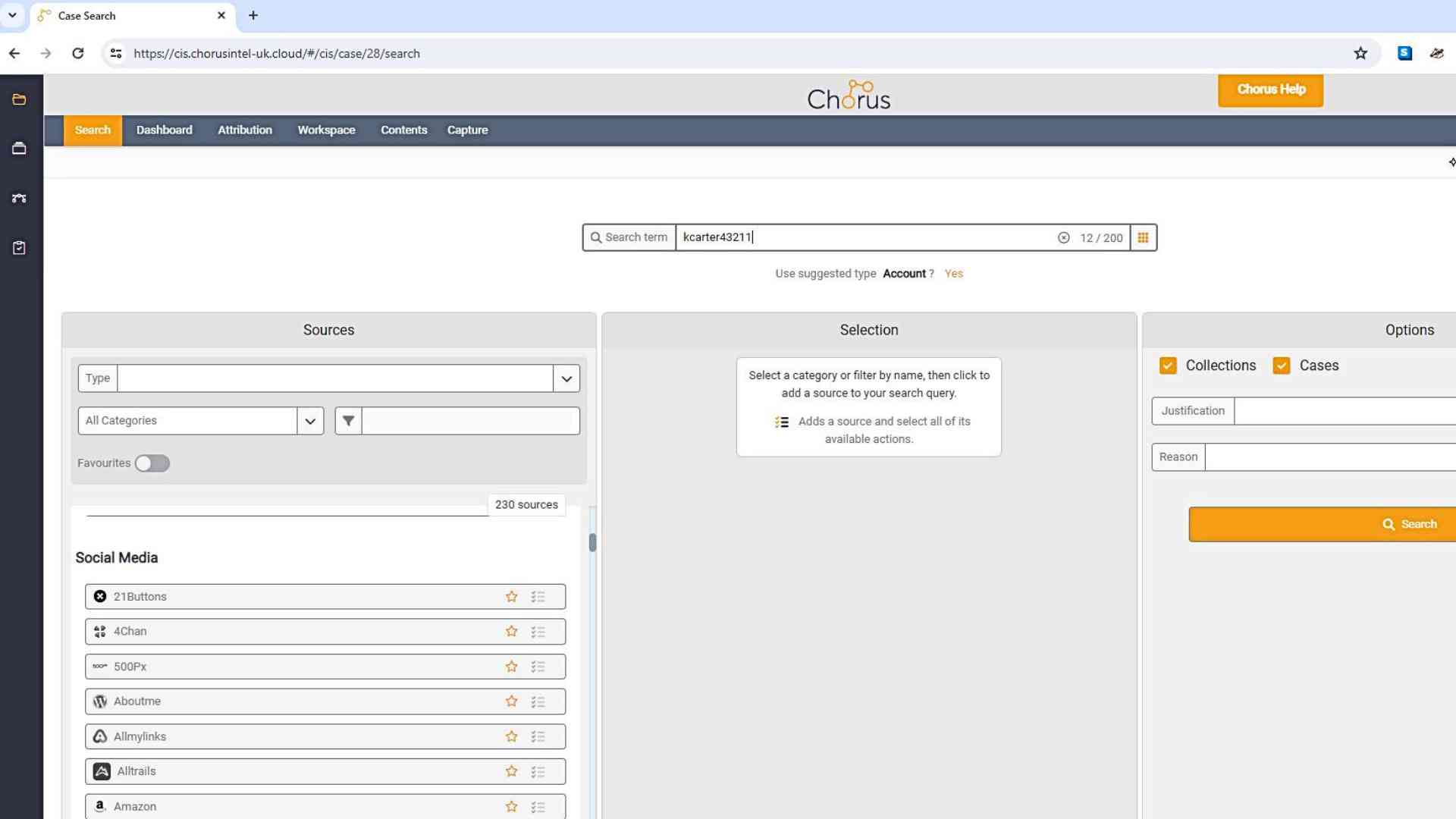

Federated Search & Enrichment

Minimise the risk of missed evidence

Search across many third-party integrations, such as business and ultimate beneficiary ownership databases, person (PII) searches, other risk signals, and hundreds of social media platforms.

Query and search across all integrations from one place and at one time, minimising the risk of missed evidence.

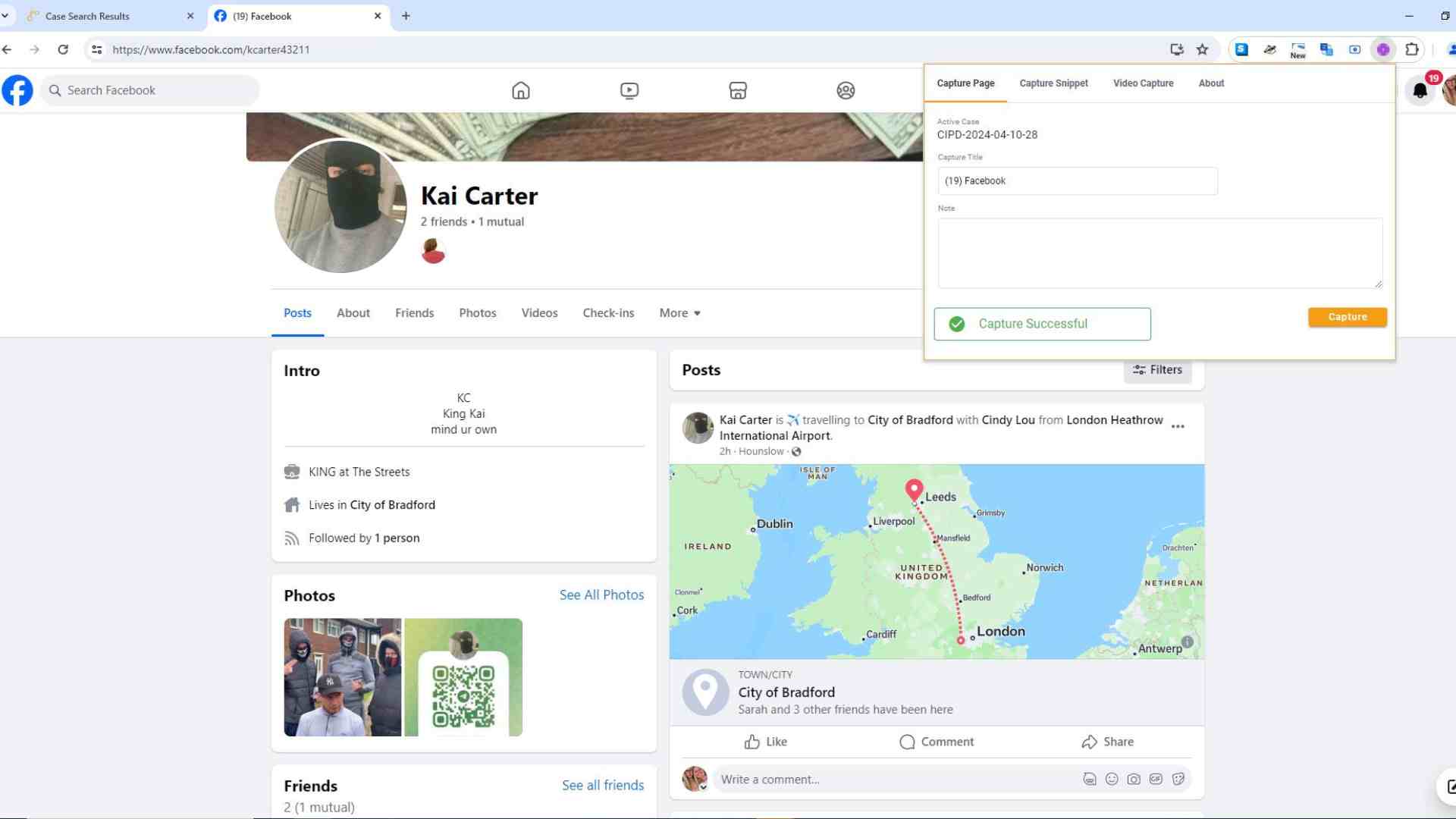

Secure Open-Source Capture

Anonymously capture evidence found online

Protect your identity whilst conducting OSINT searches, direct from the CIS, via an IP-obfuscated environment.

Capture whole (or snippets) of webpages and videos in one click and instantly save to your case in the CIS.

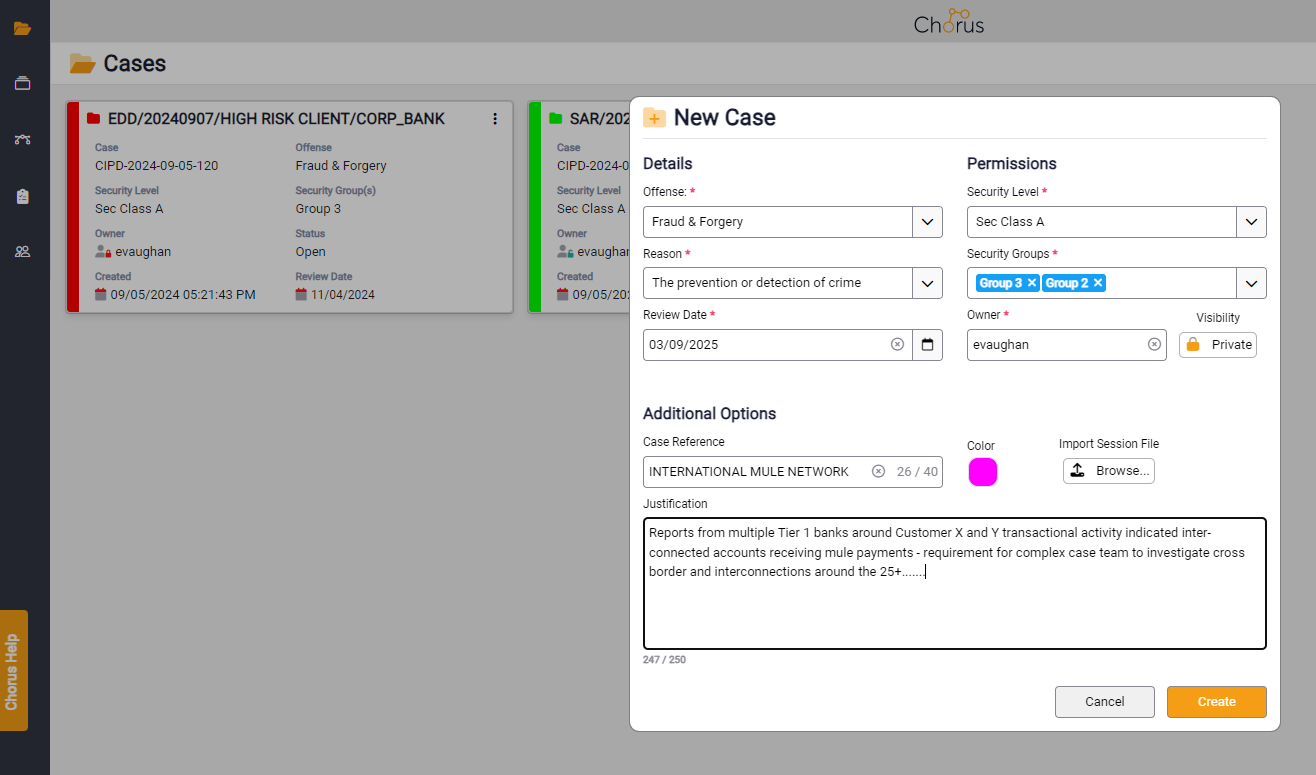

Case Management & Sharing

Store, search and share all digital data in one place

The CIS is a fully audited and access-controlled

digital repository for case storage, collaboration and sharing.

Securely share data across all your organisational lines of defence, as well as strategic investigation collaboration with external agencies.

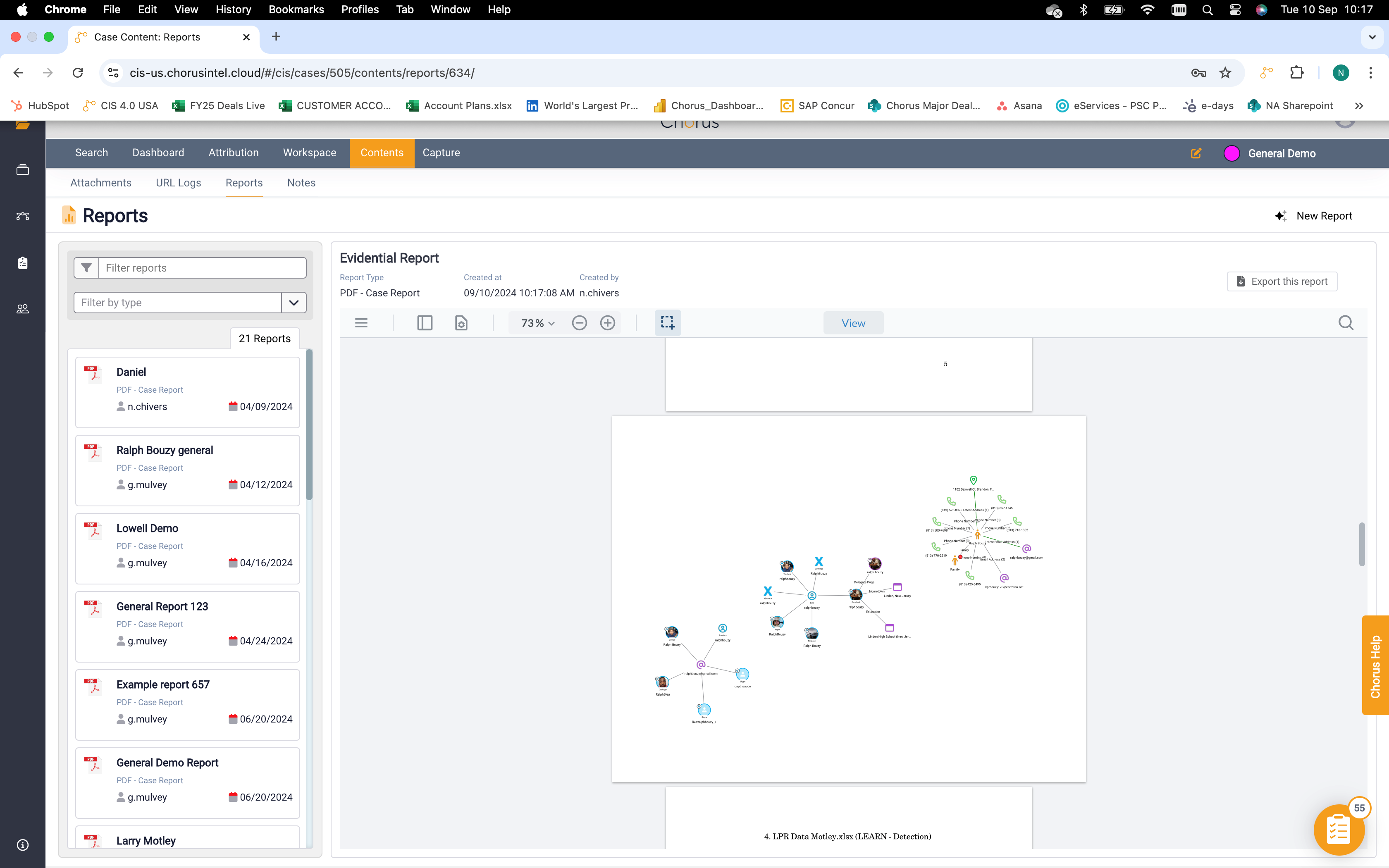

Evidential Reporting

Customise your dashboard and report intelligently

Create custom reports within the CIS, which can be shared, disclosed and exported in .csv or .PDF format with internal risk committees, regulators and global law enforcement agencies.

Overlay analytical, open-source and internal data. Visualise, expand and report in multiple ways to easily spot connections.

A stronger response to financial crime

The responsibility for detecting, deterring and disrupting financial crime sits squarely with the financial services industry. The CIS resets your approach by helping you to:

Stop crime dead, directly at its source

Analyse, expand and report in one interactive dashboard to easily spot connections

Future-proof your digital investigations

Be ready for the future of interoperability between financial services and law enforcement

Stay compliant and control reputational risk

Optimise compliance with a single source of truth and foster an impeccable, trustworthy reputation

Increase profitability

Significantly reduce losses and fines relating to fraud and mitigation of cyber and insider threats

Improve efficiency

Improve working practices, minimising non-value creating activities

Build customer confidence

By solving crime and acting responsibly

The opportunity has already arrived

Already the trusted digital investigation platform for UK law enforcement and government agencies, and now in action with a large global bank, we’re empowering investigations at every stage. The CIS detects, deters and disrupts financial crime and ensures that you turn data into intelligence and evidence, with confidence.

“The CIS will significantly enhance their ability to uncover, analyse and detect key lines of enquiry, helping it to mitigate the risk of offenses such as fraud and money laundering going undetected. The CIS addresses this issue seamlessly, setting a new standard for the financial sector in mitigating risks associated with financial crimes.”

Neil Chivers, CEO, Chorus Intelligence

Why Chorus?

Trusted to the extreme

We are endorsed by the highest authorities, trusted by 100% of the UK’s counterterrorism forces, and 80% of all police forces’ complex crime investigation units, as well as major government organisations. We also have a growing presence within law enforcement and federal agencies across North America.

Complexity Simplified

We provide a single source of truth across multiple data sources, with advanced data search, analysis, cleansing and evidence enrichment software. All via one platform, one dashboard and one login.

Evidentially Proven

Chorus has been at the heart of evidential prosecution of serious and organised criminality and terrorism for more than 15 years. We stop crime at the source, dramatically cutting the cost of fraud and money laundering.

Built around your challenges

As well as having in-house experts, recruited from our clients’ industries, we work closely with you to understand your needs. 90% of our system functionality is developed based around our clients’ specific requirements.